Whitepaper

Abstract

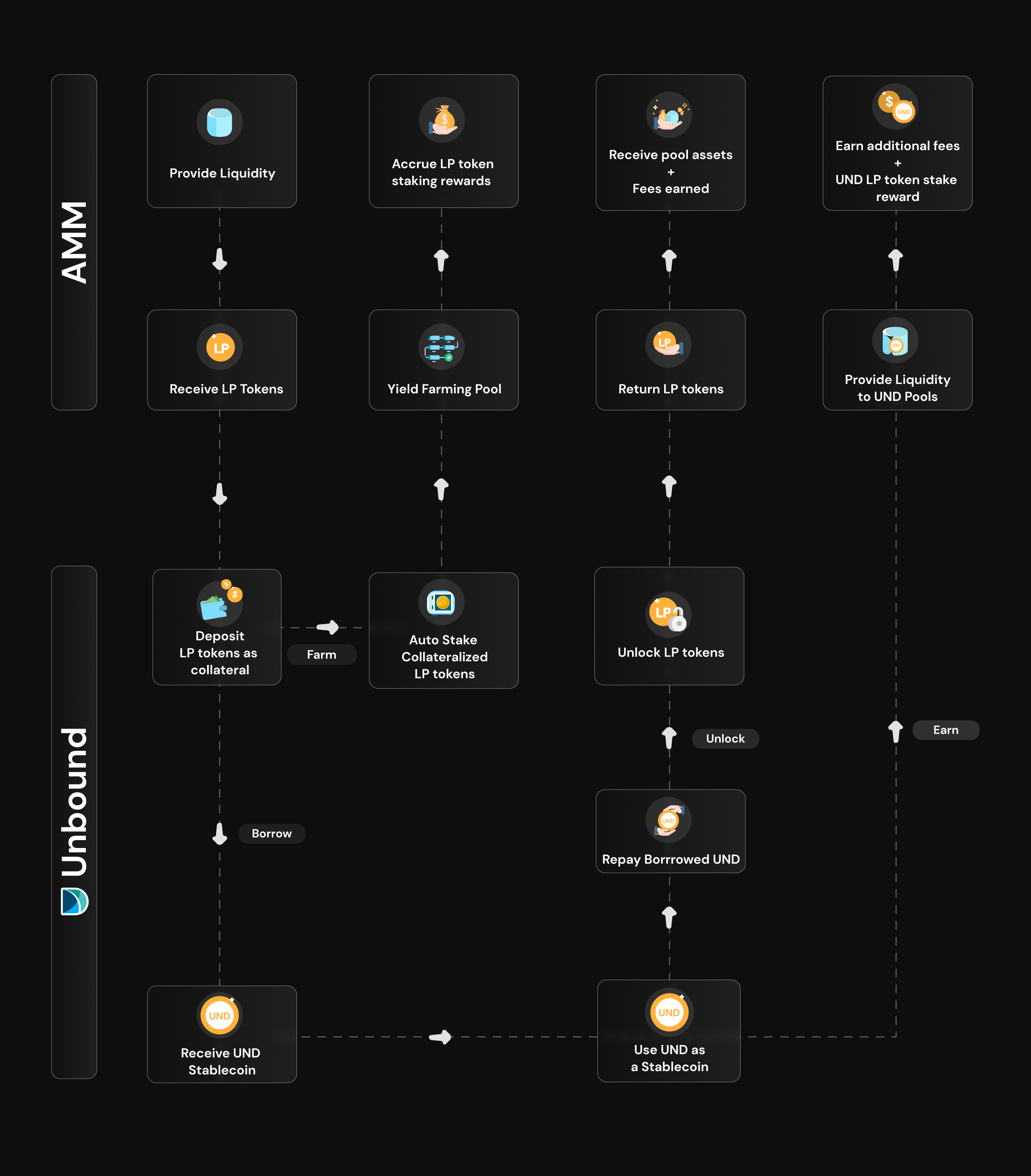

Unbound Finance is a decentralized, cross-chain lending protocol that enables DeFi users to borrow over-collateralized synthetic asset loans by pledging their idle interest-bearing tokens (ib tokens) at a 0% interest rate. While being collateralized, the tokens will continue to accrue transaction fees from liquidity provisioning to the underlying pool. Borrowed funds can be used to lend, borrow, trade, or even acquire more ib tokens to gain additional returns on the same initial capital. `

The rewards generated from automated yield farming of the deposited assets can compound the users’ APY. The platform provides liquidity to the AMM LP tokens and issues UND stablecoin as a minted token. The protocol unlocks the collateralized assets once the UND is returned. Primarily driven toward creating a composable DeFi solution, Unbound is one of the first projects to allow the collateralization of Uniswap v3 positions.

Introduction

The inception of Automated market makers (AMM) took the decentralized financial industry by storm with some of the largest DEXs such as Uniswap, Curve, SushiSwap and Balancer, among others contributing a substantial portion of the DeFi liquidity on Ethereum and other blockchains. While these systems proved to be pivotal in democratizing liquidity provisioning, capital efficiency largely remained a challenge.

As such, Unbound identified the ability to leverage LP tokens as a significant DeFi opportunity. The protocol created a robust lending architecture that enabled users to borrow interest-free crypto loans by pledging their idle LP tokens. Unbound v1 eliminated the need for a liquidation engine by supporting LP tokens of stablecoin asset pairs and relied on SAFU reserves to safeguard user deposited collateral during times of extreme volatility.

The next-gen of automated market makers including Uniswap’s latest iteration (Uni v3) are further innovating the DeFi space by enabling capital providers to concentrate their liquidity in custom price ranges, replacing LP tokens with non-fungible liquidity positions. While these inherently capital-efficient versions continue to amass billions of dollars in TVL, the complexity in utilizing the unique positions as collateral is a hurdle that is preventing LPs from realizing the full potential of their capital.

In this paper, we present Unbound as the ultimate money lego built on top of AMMs that allows users to unlock additional value to use while still generating an unperturbed passive yield from liquidity provisioning to the underlying pool. By allowing users to borrow against their liquidity positions, Unbound aims to improve the capital efficiency for the borrower and DeFi as a whole.

Unbound in its latest iteration will enable users to collateralize the concentrated liquidity positions in Uniswap v3 and other new age DEXs. Unbound v2 will rely on liquidation and redemption mechanisms to keep a check on the fluctuating prices of UND and to introduce LP tokens of more volatile asset pairs to be used as collateral.

Key Features

Unbound Finance is a novel, non-custodial lending platform, driven towards enabling newer and better opportunities of yield with a view to improving the overall capital efficiency of the DeFi ecosystem. Through synthetic assets like UND stablecoin, Unbound aims to unlock the liquidity available in DeFi DEXs and to enable the easy flow of this liquidity from one chain to another without actually removing it.

The key highlights of protocol are as follows :

- Interest-free borrowing: Unbound does not charge any interest on the borrowed UND.

- Perpetual borrowing: At Unbound, borrowers have unlimited maturities. Users can unlock the underlying collateral any time by simply paying off the outstanding debt.

- Stablecoin UND: UND is the first flagship product of the Unbound protocol. It is a decentralized, cross-chain stablecoin designed to be native to the AMM space.

- Factory Smart Contracts: Unbound makes use of liquidity lock contracts that are permissionless and support EVM-based AMMs like Uniswap, Balancer, Curve, SushiSwap and the like.

- Collateralizing concentrated liquidity positions: Unbound is one of the first protocols that allows concentrated liquidity positions to be used as collateral for borrowing synthetic crypto assets such as UND stablecoin.

Core Functions

Unbound provides four main services in the form of fully automated smart contracts that do not require any third-party intervention.

|

|---|

Borrowing

Unbound enables users to borrow interest-free crypto loans by depositing their LP tokens as collateral. Loans will be issued in the form of the protocol’s native stablecoin UND. The UND token represents a decentralized stablecoin pegged to the US dollar.

Unbound Vaults

In Unbound v1, the protocol provided support for LP tokens of stablecoin asset pairs only. All collateral asset types were treated equally and shared the same collateral factor. The amount of UND that can be minted by a borrower was algorithmically calculated by the protocol’s smart contracts based on parameters like the Loan-To-Value ratio (LTV).

The new version of Unbound has been designed to enable users to borrow UND by collateralizing LP tokens of volatile asset pairs along with stablecoin LP tokens. The protocol will also provide support for concentrated liquidity positions to be used as collateral.

In Unbound v2, reserve assets will be represented by vaults. There will be a separate vault for each collateral asset type supported by the protocol. Every time the protocol whitelists a liquidity pool, a new vault will be created to accommodate the new asset type.

Users can borrow UND by locking up LP tokens or ERC-20 tokenizations of concentrated liquidity positions of select pools in one or more vaults on the Unbound platform. The amount of UND that a user can borrow is limited to the user’s borrowing capacity. At any time, a user can borrow a loan valuing less than or equal to the borrowing capacity but not exceeding it, to secure the underlying reserve assets from collateral liquidation.

The borrowing capacity is algorithmically determined by the smart contract based on the Minimum Collateralization Ratio (MCR) of the vault. The MCR is set to be different for each collateral asset type and will vary across vaults.

Borrowing Capacity = (Value of the collateral (USD) / MCR (%) )*100

Borrowing Fee

Similar to the previous version, Unbound v2 does not charge any interest on the loan issued to the user. The protocol, however, charges a one-time borrowing fee on the amount of UND drawn against the collateralized assets. The fee gets added to the borrower’s debt each time UND is borrowed. To unlock the underlying liquidity backing the loan, the user must repay the total borrowed UND plus the borrowing fee.

The borrowing fee acts to provide stability to the Unbound ecosystem and will remain variable to help UND maintain its dollar peg. It can range from a minimum of 0.5% to a maximum of 5%. The borrowing fee is a function of the base rate and the borrowed debt (valued in UND) and is given by the formula:

Borrowing fee = (baseRate + 0.5%) * UNDDebt

Example: A user deposits collateral worth 10,000 USD to draw 6000 UND. Assuming a current base rate of 0.5%, the resulting borrowing fee for the user will be calculated as:

Borrowing fee = (0.5% + 0.5%)*6000 = 60 UND. Thus the user will incur a total debt of 6060 (6000 + 60) UND that must be repaid in order to unlock 100% of the collateral.

Unlocking

Unbound loans are perpetual, which means there is no deadline for the repayment of UND loans borrowed by the users. Users can withdraw their collateralized assets anytime, without any restriction, by repaying the outstanding debt partially or completely along with the borrowing fee.

At each instance, the Unbound smart contract calculates the amount of collateral to be unlocked by recalculating the collateralization ratio (CR) based on price feed from the price oracles. The UND thus returned by the borrower is taken out of circulation and burned as a part of the unlocking process.

Yield Farming

With a view to maximize the yield generated from user deposits, Unbound v2, will auto-stake the collateralized assets into the most trusted and profitable yield farming pools. Rewards so generated will be distributed to all the borrowers on a pro-rata basis.

Once the user unlocks liquidity from the Unbound platform to withdraw the collateralized assets, the tokens will get unstaked from the farming contract and the rewards accumulated thereon will be claimed and automatically transferred to the user’s wallet by the protocol’s smart contracts.

Earn

UND holders can earn additional rewards by providing liquidity to the UND pools across various DEXs through the Unbound platform. To further boost their APY, users can stake the LP tokens received thereon into the supported farming pools or collateralize them at Unbound to borrow more UND. Rinsing and repeating the process several times will result in compounded yield for the users.

Price Stability Mechanism

Liquidation

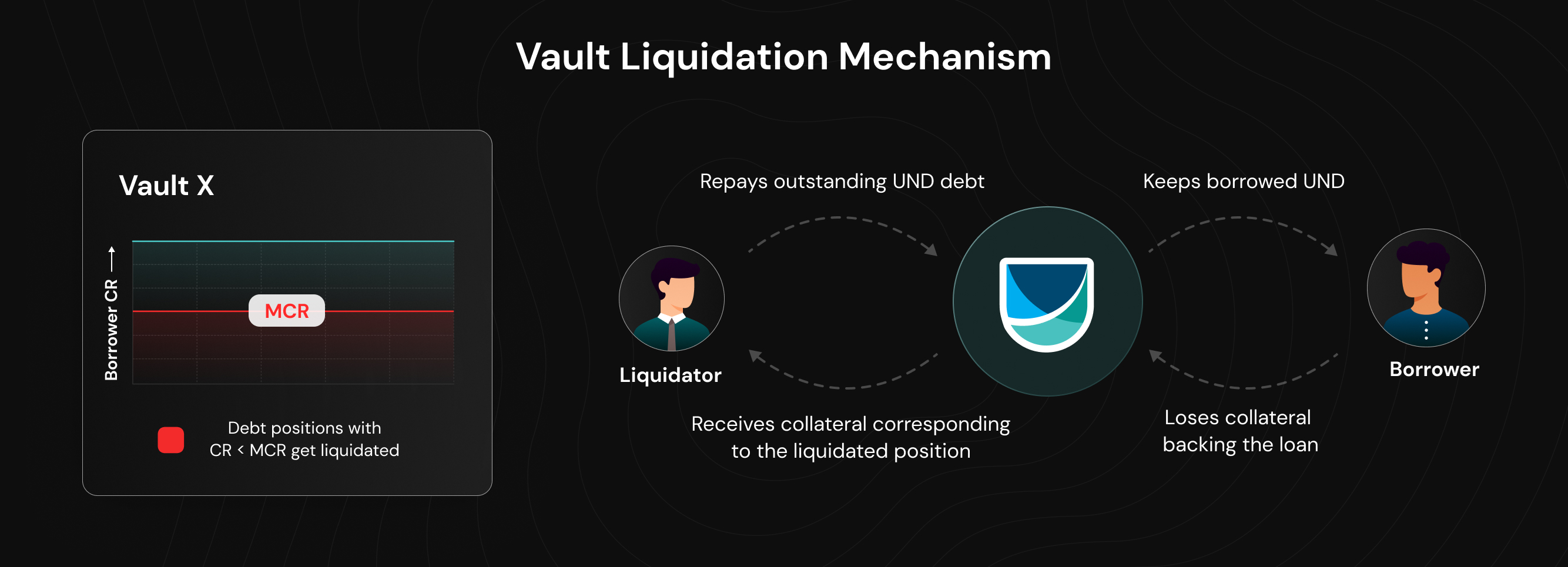

To secure the protocol against extreme market dynamics, Unbound v2, similar to v1, opts to use the approach of over-collateralized loans. This means, that at all times, the value of the collateral backing the debt should be greater than the value of the borrowed UND. Evolving beyond the characteristic no liquidation feature, the protocol, in its new version, will adopt liquidation to improve price stability.

Loan positions can be liquidated if the collateral ratio of the user’s debt position moves below the Minimum Collateralization Ratio (MCR) of the corresponding Unbound vault. This can happen when the underlying collateral backing the loan decreases in value.

Anybody can initiate the liquidation of an unhealthy debt position. The liquidator repays the borrower’s total outstanding debt in exchange for the collateral, effectively causing the borrower to lose the associated liquidity backing the loan.

|

|---|

To avoid the risk of liquidation, it is critical that the borrowers maintain a Collateralization Ratio (CR) greater than or equal to the Minimum Collateralization Ratio (MCR) of the corresponding Unbound vault throughout the lifetime of the loan. At any time, users can ensure that the loan is sufficiently collateralized by repaying part of their debt or raising the collateral value by depositing more assets. While users can still lose collateral due to redemptions, users are ideally required to maintain a healthy margin between the collateralized assets and the borrowed funds.

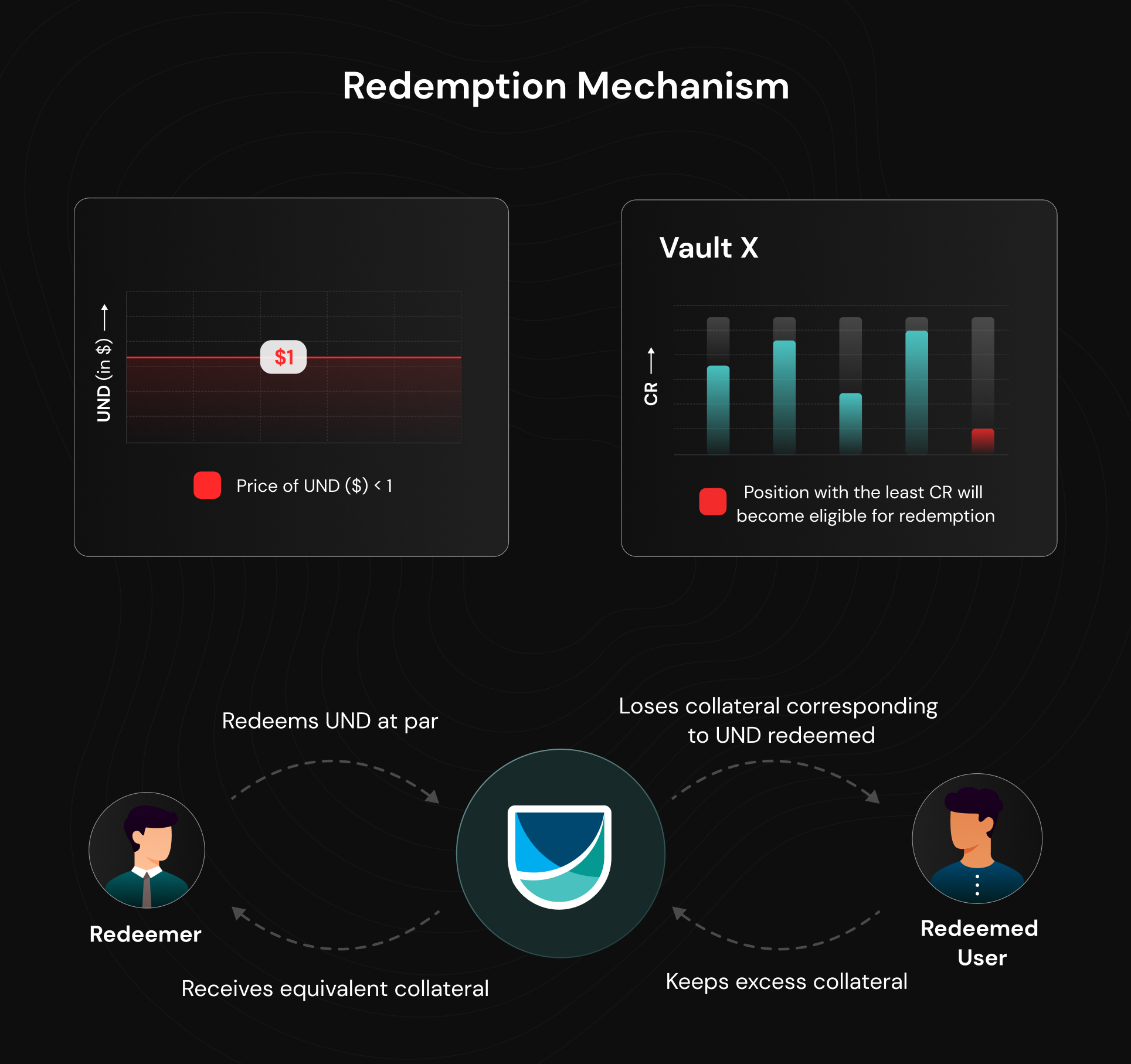

Redemption

Unbound v2 uses redemption as a price stability mechanism to ensure that the UND token maintains a stable value relative to the US dollar, a fiat currency to which it is linked. The protocol enables users to capitalise on the arbitrage opportunities that occur as a result of the difference in the market price and peg value of UND.

In the period when the USD price of UND drops below parity, users can buy UND at a cheaper price from the market and redeem it at par for the underlying reserve asset. UND returned through the process gets burned, decreasing supply and subsequently bringing the token's price closer to its target ($1).

In a reversed scenario, when UND trades at a premium, users get access to higher leverage position with respect to USD. If the market premium is above the MCR of a particular vault it gives rise to a straightforward arbitrage opportunity. Users may borrow UND from the platform at the target price ($1) and sell it in the secondary market at a higher ongoing price to capture the difference as profit.

At any time, a UND holder may trigger the redemption of a debt position by paying back UND at face value and in return gain collateral equivalent to the amount of debt repaid. The redeemer, however, will be charged a redemption fee by the protocol. For each vault, the debt positions with the least collateralization ratio are first eligible for redemption. The underlying collateral, after deducting the redemption fee, is automatically transferred to the redeemer’s wallet by the Unbound smart contracts.

Upon redemption, the affected user tends to lose only the collateral equal to the value of the loan repaid by the redeemer, resulting in no net loss, unlike liquidation. In essence, redemption improves the CR of the redeemed account, placing the borrower in a less risky position.

|

|---|

A debt position will automatically close if its complete loan gets paid off during the redemption process, allowing the borrower to regain the excess collateral assets.

Redemption Fee

A redemption fee is charged by the protocol on the amount of collateral retrieved by the redeemer by exchanging UND at face value and is given by the formula,

Redemption Fee = (baseRate + 0.5%)* CollateralDrawn

Example: If the current base rate stands at 0.5% with collateral worth $10,000 redeemed at par against UND, then a redemption fee = $100 ((0.5+0.5)% *10,000) is payable by the redeemer to the protocol. Thus the redeemer earns a net collateral worth $10,000-$100 = $9900.

The base rate increments upon each redemption by an amount proportional to the fraction of the total UND supply that was redeemed and can be defined as:

b(t) = b(t-1) + δ*(x/y)

Where, b(t) = base rate at time t

x = amount of UND redeemed

y = total supply of UND in circulation

δ = constant value set to 0.5

On the contrary, the base rate decays with the time passed since the last fee event (last redemption or last issuance of UND) and can be calculated as:

b(t) = b(t-1) * (λ^Δt)

Where λ = decay factor such that the half-life of the base rate is 12 hrs

Δt = time passed since the last redemption or loan issuance

Note: At system launch, the base rate is initialised to zero percent.

The redemption fee and the borrowing fee are directly affected by any change in the base rate. A rise in the base rate induces an increase in the borrowing fee, making it pricier for users to borrow UND. Consequently, the shrinking supply will lead to greater demand for the token, putting upward pressure on its value towards the $1 parity. In addition, a higher redemption fee will effectively lower the rate of redemption and avoid the inflow of excess UND in the system, having a stabilizing impact on the UND market price.

Tokens

The Unbound protocol is a dual token ecosystem. It uses UND as a stablecoin and UNB as a governance token.

UND - The Decentralized Stablecoin

UND is the native stablecoin of the Unbound platform issued to the users as a debt against their collateral. It is a decentralized, cross-chain, ERC-20 stablecoin, soft pegged to the US dollar. UND is backed by user-provided collateral. The amount of UND to be borrowed by the user depends upon the current value of the reserve asset locked by the user and the MCR of the corresponding Unbound vault. The borrowed UND will be burned once deposited in the Unlock contract before the underlying collateral is returned to the user.

UNB - The Unbound Governance Token

UNB is the governance token of the Unbound protocol. The token infers voting rights to its holders and encourages participation from the token holders by way of decision-making. Token holders will be able to vote for policy on proposed changes and implementations to better serve the community and increase the efficiency of the protocol.

Some of the responsibilities of UNB holders can be listed as follows:

- Vote on asset pairs to be whitelisted as collateral.

- Determine the borrowing rate and Minimum Collateralization Ratio (MCR) of the whitelisted asset pairs.

- Modify the parameters that determine the borrowing rate and redemption fee.

- Modify the MCR of existing collateral asset types.

- Modify the borrowing rate per collateral asset type etc.

- Determine the global borrowing limit for each vault.

Price Oracles

Unbound depends on price oracles for deriving the price of collateral deposited by the users for all financial operations of the platform. To derive a highly secured price feed, Unbound uses Chainlink feeds. The price oracle is used to convert the value of the collateral in terms of USD to issue the UND stablecoin.

Conclusion

Unbound is the next logical step in the evolution of decentralized finance. The platform enables concentrated liquidity positions and LP Tokens to be used as collateral for borrowing Unbound’s stablecoin UND. UND, being a stablecoin, has unlimited use cases. Unbound’s native UNB token confers voting rights to its holders in matters of the DAO. These votes can be used to bring about changes and to have a say in the future direction of the platform.